Capital stock is issued when a corporation goes public and it needs to raise capital. An organization can issue both common and preferred stock to raise capital in an exchange of rights and ownership of the corporation. This capital is retained so if the organization requires to pay its creditors, it can do so.

Example:

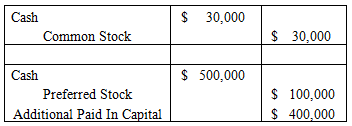

Adequate Disclosure, a newly owned public company, requires raising capital stock to finance majority of its operations. Adequate Disclosure issues 5,000 common stock for a par of $6 and 20,000 preferred stock ($5 par) for $25. What is the amount of capital stock?

The amount of legal capital is: 30,000 + 100,000 = $130,000